Fantastic Tips About How To Reduce Tax Penalties

[see services that can help]

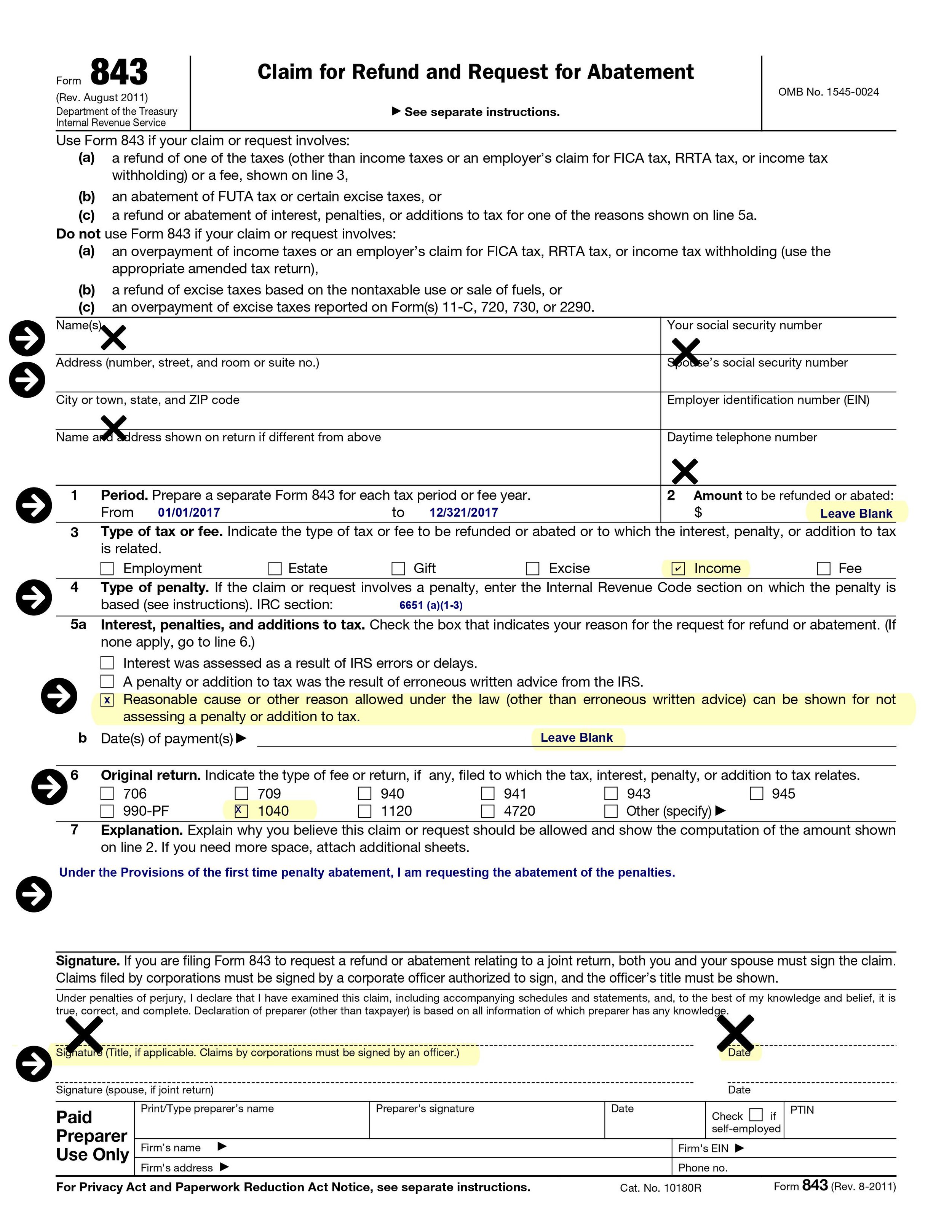

How to reduce tax penalties. This penalty equals five percent of unpaid. If you set up a monthly payment plan with the irs (called an installment. You can also write a penalty abatement request letter to the irs, and enclose a copy of your irs notice showing your penalty, as well as any written documentation that you have in support of.

One way around this is to take your total tax liability from last year (the amount owed, not the amount paid) and divide it into four quarterly payments. Set reminders on your phone or work with a cpa to ensure you are not. Your best bet is to avoid these penalties by remembering to pay estimated taxes every quarter.

Get help for help with a penalty, call the phone number on your notice or letter. But, if that’s not possible, you have options. One way to get penalties waived or reduced is to work with your tax attorney to prove that there were circumstances beyond your control that prevented you from paying the owed taxes.

During the call, we’ll tell you if your penalty relief is approved. The best way to stop interest from building up is to pay the full tax bill. There are many different types of penalties that can potentially be abated.

You will continue to accrue interest until you’ve fully paid off your tax debt. You can avoid a penalty by filing accurate returns, paying your tax by the due date, and furnishing any information returns timely. If you set up an irs installment agreement, the irs will reduce your failure to pay penalty to 0.25% of the tax you owe while the installment agreement is in effect.

Accordingly, in order to avoid an estimated tax penalty, a taxpayer must generally pay throughout the year, in some combination of estimated tax payments and withholding, an. Know your options—speak to one of our experienced cpa / irs enrolled agents now. You will want to apply these funds in a way.

Ad guaranteed results from a+ bbb firm with 28 years in practice. Get help for help with a penalty, call the phone number on your notice. If you set up an irs installment agreement, the irs will reduce your failure to pay penalty to 0.25% of the tax you owe while the installment agreement is in effect.

If you didn’t receive a notice, use. End your tax nightmare now. Ad let us find you the best tax relief company in your area & get help with back taxes.

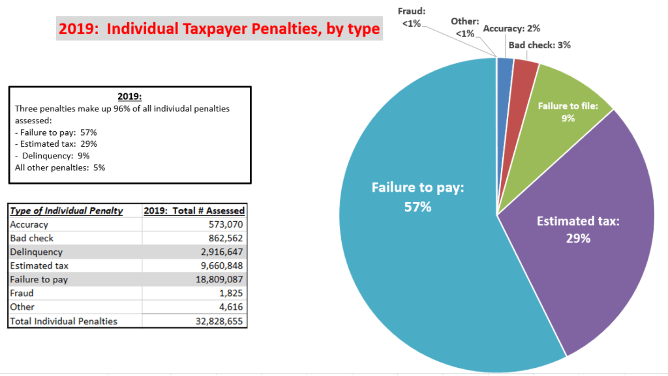

You may reduce future penalties when you set up a payment plan. Unlike the failure to file and failure to pay penalties, it does not accrue monthly. How you can reduce the penalty when you file form 941 to report the payments you made, you can pay any additional funds you owe at that time.

If you can’t do so, you can apply for an. However, you must use the correct process to get your tax penalties removed. Unlike penalty abatements, there aren’t specific things you can do to reduce accrued interest on a tax debt.